Retirement, just like your career is a series of personal decisions. It all depends on your personal math – the science behind retirement.

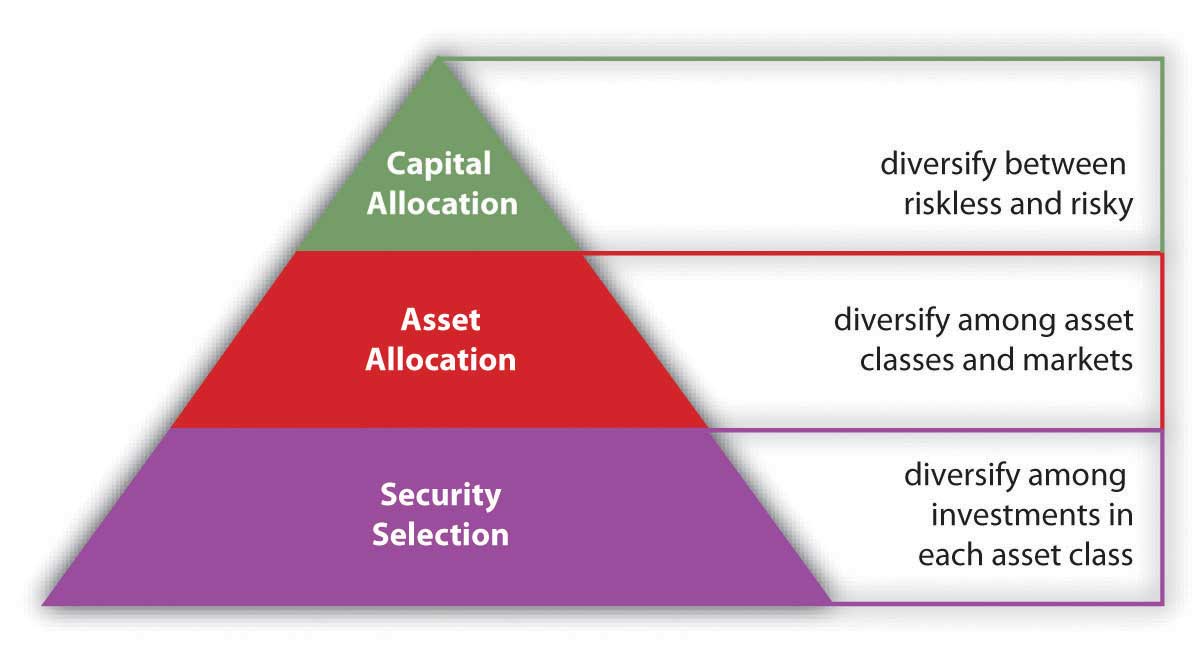

Generally, what investors have learned over time is that the mix of your assets (stocks, bonds, cash), has a far greater impact on your investment returns than what you buy within those asset classes. It is important to monitor your mix to ensure that it meets your risk tolerance, rebalance your portfolio to capture gains, and make sure that your investment strategy aligns with your goals.

It’s important to ask yourself these mathematical equations:

- How much cash flow do you need to make your life work?

- Once we subtract out your fixed sources of income (like social security or pensions) what is the difference?

- Then, do you have enough to generate the above number over a long period of time? Once you have that answer you’ll know if you are able to retire.

Still, while working towards your retirement goals it’s important to understand the difference between saving and investing. You should always save before you invest. It is a good idea to have at least 3-6 months’ worth of your expenses in cash, readily available to you. This is important because if you run into unforeseen expenses you have access to your money immediately, without worrying about what investments to sell or if there are penalties or taxes for accessing that money.

Once you have what you feel is a comfortable amount of savings, it is important to invest, to your risk tolerance, in order to build a diversified portfolio. Cash is an important component of a financial plan, but in an effort to increase the potential for returns (outside of the low interest rate in savings accounts), it is a good idea to create a diversified portfolio of equities and fixed income instruments to build for, or maintain the needs, you will have in retirement.

Feel like you need more help? Here is our checklist of what you should ask a financial advisor before working with them.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

.png)